What Happens If You Have A Bounced Check?

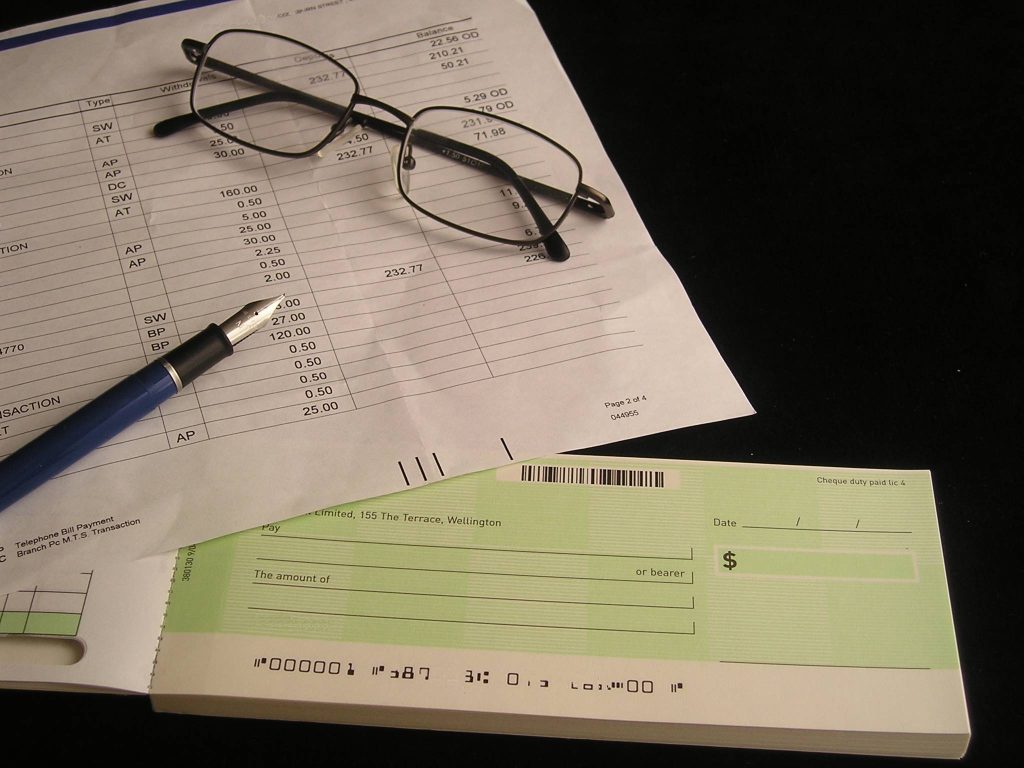

A bounced check, commonly called a “rubber check,” occurs when the account doesn’t have sufficient funds to cover the amount. This can happen inadvertently due to various factors, such as unforeseen expenses or errors in calculating available funds.

When someone writes a check, they authorize their bank to transfer a certain amount to the recipient’s account. However, if the account doesn’t have enough balance to fulfill this transfer, the check bounces, resulting in consequences for the issuer and the recipient.

An immediate repercussion of a bounced check is the imposition of fees. This includes the non-sufficient funds (NSF) fee levied by the financial institution for failing to honor a check because of insufficient funds. Merchants may also impose additional fees for bounced checks to compensate for inconvenience and potential costs. Overdraft fees may apply if the bank covers the check, resulting in the account balance going below zero.

Bounced checks can also impact one’s credit report and banking relationships. While they typically do not appear on primary credit reports, they may affect alternative checking account reporting companies, potentially leading to denied account openings. Depending on the severity of the situation, the recipient or the bank may pursue legal action, such as civil or criminal charges.

To address the aftermath of a bounced check, proactive steps should be taken, including contacting the bank and the recipient immediately, depositing funds to cover the check, and negotiating fees with the bank or merchant. Steps should also be taken to prevent future occurrences, such as creating a budget, building savings, and regularly balancing checkbooks.

Discovering a bounced check can be stressful, but taking fast action is crucial. Resolving the situation includes contacting the bank and payee promptly, depositing funds as soon as possible, and determining the fees owed. Overdraft protection may be considered to avoid future incidents.

In today’s fast-paced digital world, the exchange of funds has accelerated, making it essential to ensure sufficient funds before writing a check. Communication with the recipient is critical if there’s a possibility of insufficient funds. Proactive financial planning and responsible money management are vital to avoid the pitfalls associated with bounced checks and maintain economic stability.

A bounced check can have significant financial implications for the writer and the recipient. However, with prompt action and preventive measures, the impact can be minimized, and lessons learned for better financial management in the future.