30+ Financial Hacks That Make Our Piggy Banks Happy

Managing your finances can be challenging, especially if you are not already accustomed to budgeting and saving money. However, some people have mastered the art of handling their finances and have adopted several money-saving hacks that work for them.

These individuals have found ways to make the most of their income, save for the future, and invest wisely, all without breaking a sweat or reducing their quality of life. In this article, we will share some foolproof money-saving hacks shared by people who are good with their finances.

From creating a budget and setting financial goals to using cashback apps and shopping during sales, these tips can help you save money, stay on track, achieve your financial goals, and manage money effectively to have financial stability.

1. Join a buy-nothing group on Facebook

Joining a “Buy Nothing” group on Facebook is a highly effective way to save money and reduce waste. These groups operate on a gift economy model, where members give away things they no longer need and request stuff they need as a gift.

It creates a great sense of community and promotes viable living by reducing the need for new purchases. Members can find various items, from furniture and clothes to books and toys. By joining these groups, you save a lot of money and contribute to a more sustainable and environmentally friendly way of living.

2. Get rid of Amazon Prime

Removing the Amazon Prime app from your gadgets can be a great money-saving hack for those looking to cut back on their expenses. While Prime offers fast shipping and access to various entertainment options, it also comes with an annual fee which you pay even if you don’t use it.

Canceling the subscription can save you hundreds of dollars annually. Instead, consider shopping around for better deals, taking advantage of free shipping promotions, and utilizing alternative streaming services. With a little effort, you can easily save money without sacrificing convenience.

3. Reuse grocery bags and old rags

Reusing grocery bags and old rags is a simple yet effective money-saving hack that promotes sustainability and reduces waste. Instead of constantly buying new paper towels or cleaning cloths, using old rags and washable sponges helps save money in the long run.

Similarly, reusing grocery bags as trash bags reduces the need to purchase plastic trash bags, saving you considerable money over time. By adopting this habit, you can significantly reduce household waste and contribute to a more sustainable and eco-friendly lifestyle while saving money.

4. Choose a credit union over a bank

Credit unions are a great way of saving money as they are non-profit financial cooperatives that typically offer lower fees, higher interest rates, and better loan terms than banks. Credit unions are owned by their members, which means they prioritize their member’s financial well-being over profit.

Moreover, it often offers free financial counseling, education, and other resources to help its members manage their money effectively. You can save money on fees and interest rates and gain access to valuable financial resources by joining a credit union.

5. Treat yourself once a month

Treating yourself once a month is an effective money-saving hack that allows you to indulge in something you enjoy without breaking your budget. Setting aside a little amount of money each month allows you to treat yourself to something special, whether it’s a nice dinner or a day trip.

This habit helps you stay motivated to stick to your budget, as you have something to look forward to each month. Additionally, it can prevent impulse purchases, as you’re less likely to overspend when you have a planned treat. Overall, this hack helps you balance your financial goals with some much-needed self-care.

6. Balance your account daily

Balancing your account daily is an ingenious money-saving hack. By tracking your expenses and income daily, you clearly understand your financial situation, avoid overdraft fees and late payments, and stay on top of your spending habits. It is a must to balance your accounts.

By tracking where your money is going, you can have an easier idea of where and how much to cut back. This practice can help you keep your budget in check, save money, and avoid overspending on pricey or unnecessary items.

7. Leave your cash and cards at home

When you go out shopping, only carry the required amount of cash. By going out with only the cash you need for that particular day, you limit the amount you can spend and avoid the temptation to go over budget.

This habit also helps you to prioritize your spending, as you are forced to decide what you truly need to purchase before leaving the house. By reducing the number of unplanned purchases, you can save money, ultimately leading to a more financially stable future.

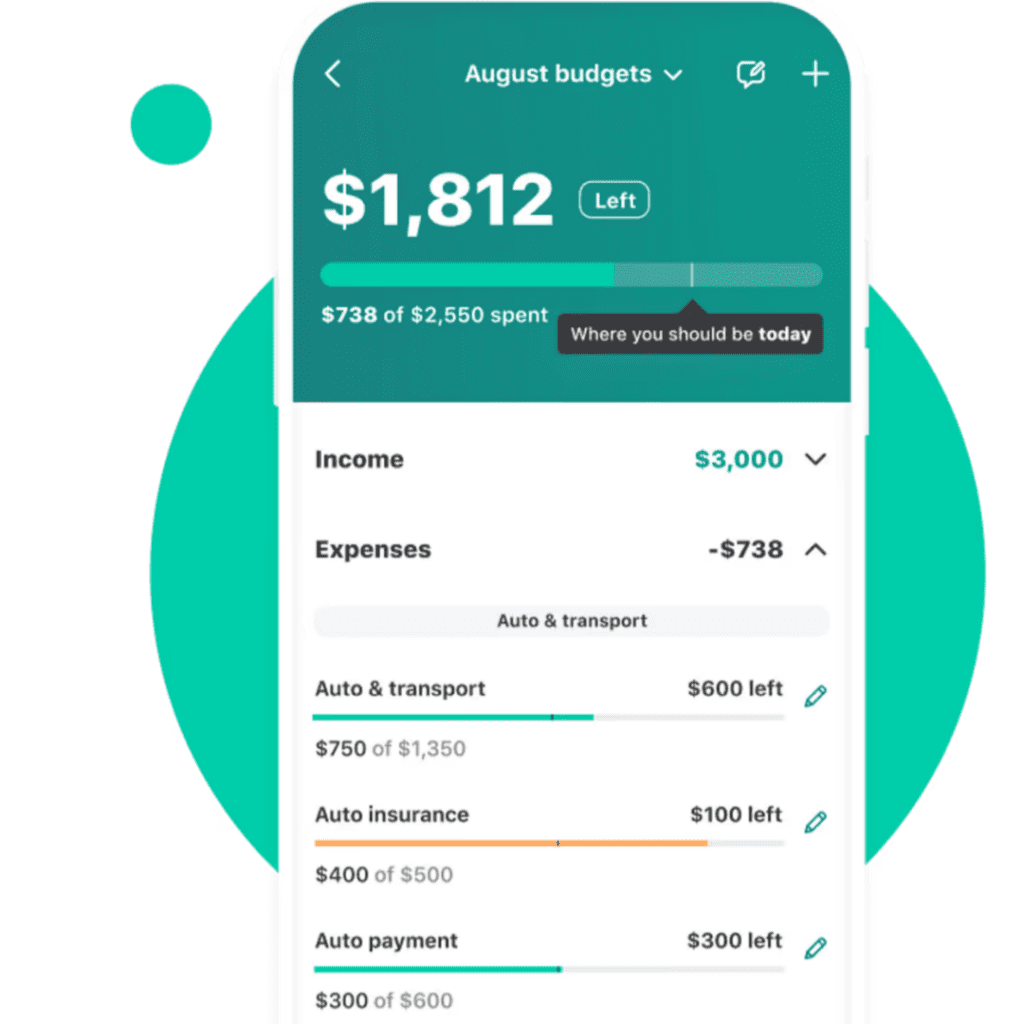

8. Use a budgeting app

You can create a free account on a budgeting app of your choice to track your expenses and pick out areas where you may be misspending. Budgeting apps have features like the automatic classification of expenses, reminders for bill due dates, and are capable of setting financial goals.

The right budgeting app will let you keep your finances in check, make buying decisions carefully, and work towards savings for any emergency or long-term goals. Using a budgeting app makes you a wise spender, manages your finances, and saves money.

9. Cut back on alcohol

Consuming alcohol can be overly expensive, even if you consume it once a week or only on weekends. Alcohol is quite expensive in restaurants and bars, and we don’t realize it makes a bigger cut in our pockets, and can be similar to buying clothes from an expensive brand.

Giving up or cutting down on alcohol consumption is an effective money-saving hack. At the very least, avoid buying drinks when dining out. Instead, invite friends over for a movie or game night and enjoy alcohol at a cheaper price.

10. Use a reusable metal coffee filter

Traditional paper coffee filters can add up in cost over time, and by switching to a reusable metal coffee filter, you can save money on this recurring expense. Reusable coffee filters also help reduce waste, as they can be washed and utilized multiple times before needing to be replaced.

Moreover, metal coffee filters are often made with durable and high-quality materials that last longer than their disposable counterparts, providing additional cost savings in the long run. Using a reusable metal coffee filter is an excellent money-saving hack that helps you save money and reduce waste.

11. Use generic medicines

Learning the names of basic over-the-counter medications and buying their generic versions can save a significant amount of money. Most store-brand medications contain the same active ingredients as their name-brand counterparts but are sold at a fraction of the cost.

By reading labels and comparing ingredients, you can easily find the cheapest option without compromising on efficacy. This can be a simple yet effective way to save money on healthcare expenses, especially for common ailments like headaches, fever, and allergies.

12. Celebrate a no-spending day every week

By designating a day each week as a no-spending day, you challenge yourself to find ways to have fun and stay entertained without spending any money. This habit helps you to be more mindful of your spending and encourages you to save money.

It motivates you to find creative ways to enjoy your time when you have to do things without spending money. Additionally, a no-spending day can help you break bad spending habits and reduce unnecessary purchases, leading to significant savings over time.

13. Sell out stuff online that you don’t need

Selling unwanted items online is an excellent way to earn some extra cash, as well as decluttering your home. You can make money to add to your savings goals or pay off debts by selling items you no longer need or use.

Selling items online is easy and convenient, as several platforms, such as eBay, Craigslist, or Facebook Marketplace, allow you to reach potential buyers in your local area. Moreover, selling items online is a sustainable alternative to throwing your stuff away.

14. Keep things in your cart for a day

When making purchases online, practicing restraint before finalizing a transaction can be helpful. You can create wishlists and/or don’t buy items right away, leaving them in your cart for a few days. You can also utilize this time to think about how useful this purchase will be.

By pausing before making a purchase, you allow yourself time to reconsider if the item is essential or if you can find a better deal elsewhere. This habit can also prevent impulse buying, save money, and promote a more intentional and mindful consumption practice.

15. Bake your bread

Baking your own bread at home is a cost-effective and healthy way to save money on groceries. Store-bought bread can be expensive, and homemade bread saves money, tastes better, and is healthier as you can control the ingredients used in it.

Making your bread also allows you to experiment with different flour and additives, such as herbs or seeds, to add flavor and variety to your meals. Additionally, baking bread can be a therapeutic and enjoyable experience that provides a sense of accomplishment.

16. Unsubscribe from sales alerts

With so many wholesalers offering sales and discounts, it’s easy to get tangled up in the excitement and buy things you don’t actually need. By unsubscribing from sales alerts, you can reduce the temptation to make impulsive purchases and only buy things you need.

Furthermore, reducing the number of promotional emails you receive can help declutter your inbox, making it easier to manage and respond to important emails. Overall, unsubscribing from sales alerts can help you make smarter purchasing decisions and avoid giving in to tempting yet financially unwise deals.

17. Boost self-control with a wishlist strategy

A wishlist strategy can be an effective money-saving hack to boost self-control when making purchases. Creating a list of things you want to buy and saving links to these items on your phone or computer gives you time to consider your purchases carefully.

This strategy can help you avoid impulse purchases, save money, and prioritize what’s important to you. By saving up for items on your wishlist, you can make sure that you only spend money on things that truly matter to you and avoid wasting money on unnecessary purchases.

18. Cut down on social media to avoid getting influenced

Social media is a powerful tool to connect with family and friends, but it can also be a source of temptation to spend money on unnecessary things. To avoid being influenced by social media, consider cutting down on your usage or deleting certain apps altogether.

By doing so, you may spend less money on things you don’t need and avoid the constraint of keeping up with the latest trends or lifestyles portrayed on social media. It can help you prioritize your spending and save money for things that truly matter to you.

19. Learn new skills

Focus on learning new skills, as it is a superb way to save money. By learning necessary skills such as cooking, gardening, or basic home repairs, you can save a lot of money on services and products you would have otherwise paid for.

Furthermore, learning new skills can lead to new job opportunities or career advancement, resulting in higher earnings and better financial stability. Learning new skills can also be a fun and rewarding hobby, providing a sense of achievement and satisfaction while also saving money.

20. Try thrift stores and Craigslist

You can find quality items at a fraction of the cost at thrift stores and Craigslist. Thrift stores offer a wide range of secondhand items, including household goods and furniture, at significantly discounted prices. Similarly, Craigslist is a great platform for finding gently used items from local sellers.

By shopping at thrift stores and using Craigslist, you can save money on everyday items for home and luxury purchases alike. These platforms offer a sustainable alternative to purchasing new items, reducing waste, and contributing to a more environmentally friendly lifestyle.

21. Cook and preserve food

By learning how to cook with quality, but inexpensive ingredients, you can make tasty meals at home that are both healthy and budget-friendly. It can add up to significant savings over time. You can also preserve food by freezing or canning it.

This will help you extend the shelf life of your groceries and reduce the amount of food you throw out—which is essentially throwing away money. Cooking and preserving food are healthy and effective money-saving hacks that can help you save money on groceries and reduce food waste.

22. Maintain a financially stable appearance

The phrase “don’t look poor” may seem shallow, but it does have some practical applications when it comes to saving money. For example, maintaining your clothes and personal hygiene can help you avoid the need to constantly buy new clothes and products.

Additionally, learning basic grooming skills like trimming your own hair and nails or tweezing your brows and trimming your beard can save you money on regular salon visits. These small things can add up over time and help you maintain a professional appearance without breaking the bank.

23. Savings with Roth IRA

A Roth IRA can be a savvy investment option for those looking to save money. While there is no tax deduction when investing, the withdrawals are tax-advantaged. This means that the money multiplies tax-free over time, making it a great way to save for retirement or other long-term goals.

Consider contributing a portion of your savings to a Roth IRA each year to take advantage of these benefits. With careful planning and a solid investment strategy, a Roth IRA can be an effective way to save for the future.

24. Find productive hobbies

Finding productive hobbies can be a great way to save money. Instead of spending your free time and money on activities that don’t add true value to your life, consider hobbies that can help you save or even make money.

You could take up gardening and grow your own produce, start sewing and repair your clothes instead of buying new ones, or learn to do home repairs and save money on hiring professionals. You can even explore crafting hobbies that allow you to sell your works, earning you some extra cash.

25. Try the pocket money system

The pocket money system involves withdrawing a set amount of cash for discretionary spending—such as coffee or eating out—at the beginning of each week or month. By limiting yourself to only spending the cash you have on hand, you can avoid overspending and make more thoughtful purchasing decisions.

This strategy can also help you to stick to your budget and avoid relying on credit cards or other forms of debt. Overall, the pocket money system can be a powerful tool for building healthy financial habits and improving your relationship with money.

26. Plan your meals

Plan your meals for the week so you can buy ingredients in bulk and avoid food waste, which equates to unnecessary buying. You can start by making a list of things you need for your meals and buy those things only.

Planning your meals in advance will also help you avoid ordering takeout. You can save an immense amount of money and simultaneously have healthy and fresh food with little but rewarding effort. Moreover, you can have variety in your meals and have a balanced diet.

27. Subscribe to one streaming service at a time

Save considerable money on entertainment by limiting the number of streaming services you use. Instead of signing up for multiple services simultaneously, consider subscribing to one service at a time and rotating as desired. It allows you to enjoy various content without paying for infrequently used subscriptions.

Many streaming services offer free trial periods, so you can try a service before committing to a monthly subscription. By being mindful of your entertainment expenses and using this strategy, you can save money while enjoying your favorite movies and shows.

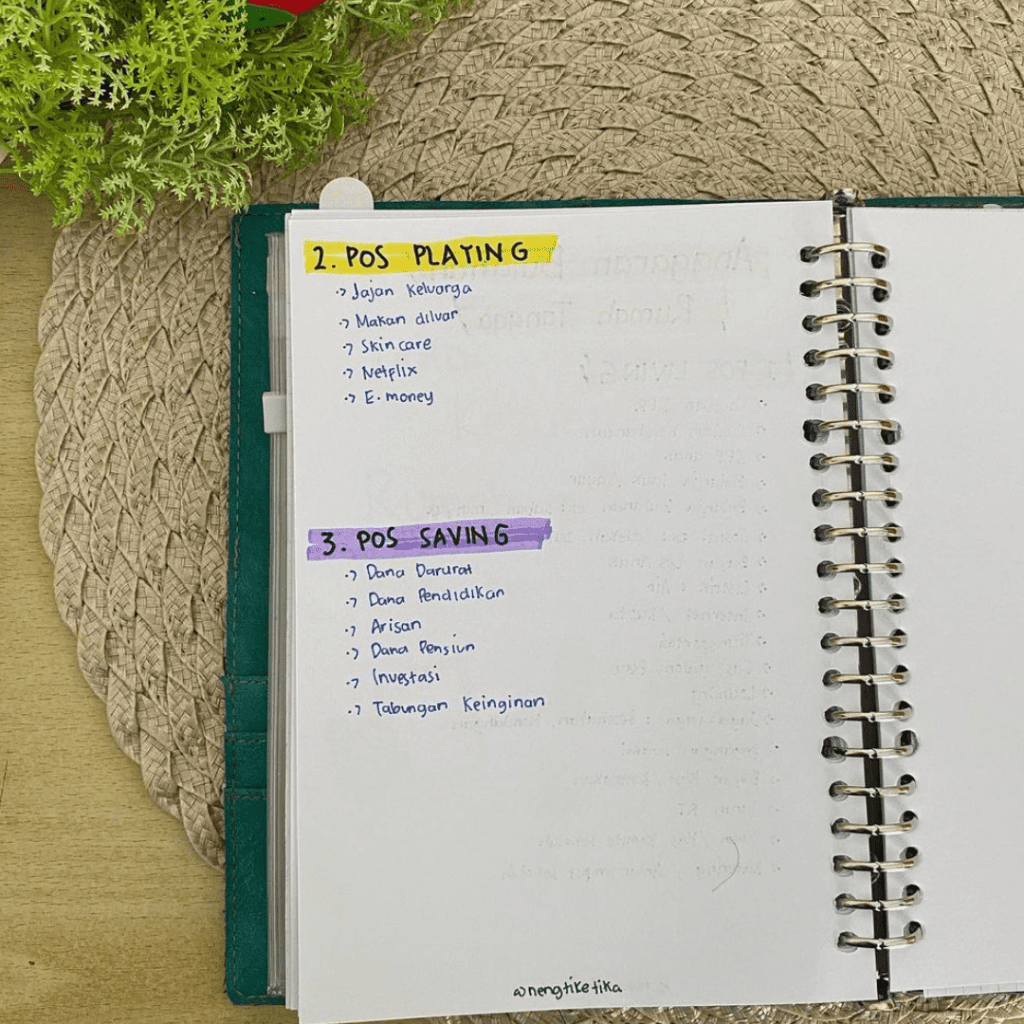

28. Budgeting is the key

One successful money-saving hack is to start budgeting (if you haven’t already). Budgeting can help you track your expenses and identify areas where you can cut costs and save money. First, list all your income sources and monthly expenses, then categorize your expenses into essential and non-essential categories.

Once you have a clear picture of your expenses, you can set realistic financial goals and develop a plan to achieve them. Many budgeting tools and apps are available to help you remain on track and manage your finances effectively.

29. Google website coupon codes

A simple way to save money when shopping online is to Google for coupon codes before making a purchase. Many retailers offer discounts and promotions through coupon codes, which can be found through a quick Google search or by visiting websites dedicated to collecting and sharing coupon codes.

Simply type in the name of the retailer and “coupon code” in a search engine, and browse through the results for any available discounts. This can often result in significant savings on your purchase, making it a quick and easy money-saving hack.

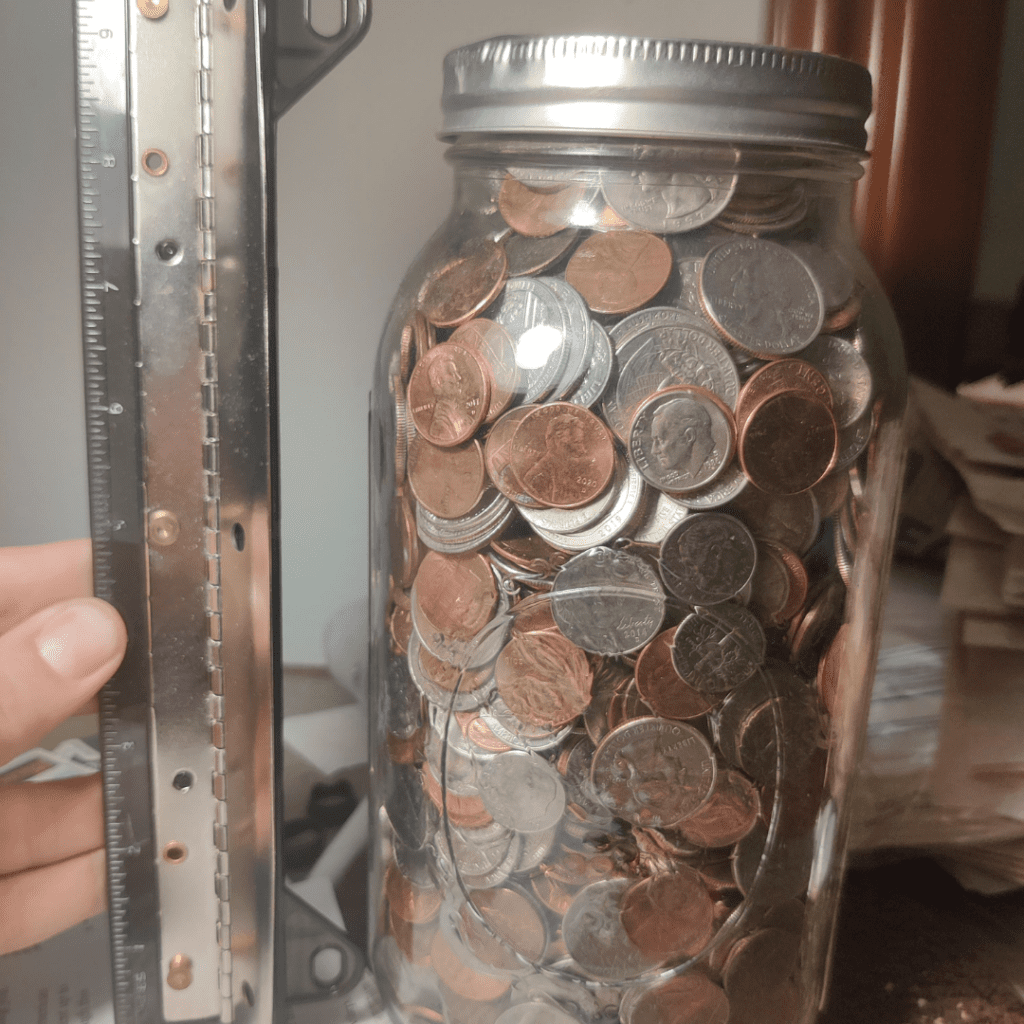

30. Save spare change

The “old school” method of saving loose change can still be an effective way to save money as an adult. Instead of paying exact change for purchases, round up and put the change into a jar or piggy a bank to add to your savings.

Gradually, this can add up to a significant amount of money that can be used to pay for unexpected expenses or a yearly surprise treat for yourself. It’s a simple habit that can make a big difference in your overall financial health, especially if you do it consistently over a long period of time.

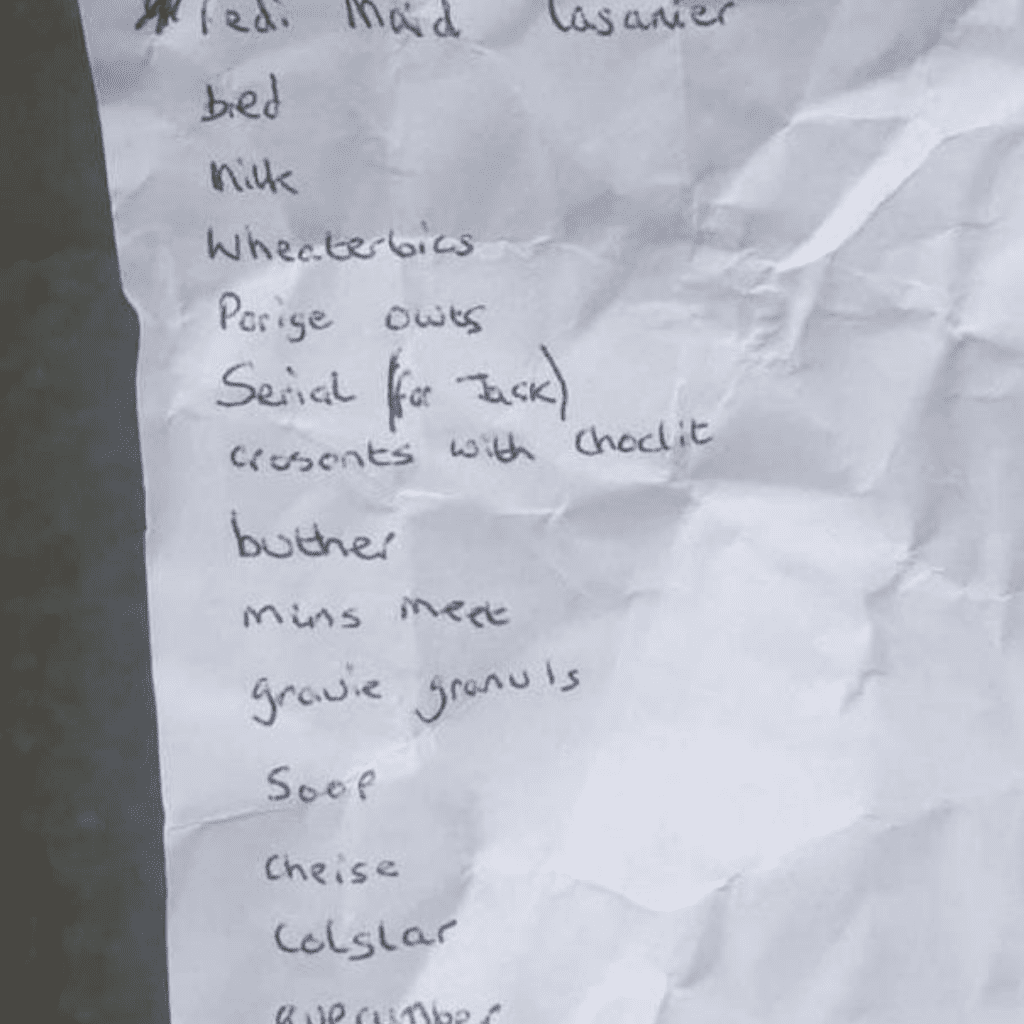

31. Create and stick to your shopping list

Creating a list of items you need to shop for is a great way to save money and avoid purchasing unnecessary items. Try to make a list before heading out shopping for groceries and stick to it religiously. It will help in avoiding and curbing impulsive buying.

Most importantly, those last-minute purchases easily lead to overspending. Make sure you go shopping with a full stomach and don’t buy things because of hunger and cravings. Oftentimes, those treats and impulse buys are the pricier items in your cart.

32. Use Amazon rewards credit card

By canceling your Amazon Prime membership and switching to a regular Amazon account, you can still earn rewards with your Amazon Rewards credit card that you can use while saving money on the Prime subscription fee. You don’t have to become a prime member to use an Amazon Reward card.

This way, you can take advantage of the rewards without the added cost of a Prime membership. Additionally, you can look for free shipping deals or bundle your purchases to reach the minimum for free shipping instead of relying on Prime’s free two-day shipping.

33. Store apps for shopping

One money-saving hack is to download the apps of your favorite stores on your cell phone but turn off notifications. This way, you can still keep an eye on sales or promotions that the store may be running, but you won’t be constantly bombarded with notifications.

When you’re out shopping, and you find something you want, not necessarily something you need, you can check the app to see when it goes on sale. This can help you save money while simultaneously avoiding impulse purchases without giving up on occasionally treating yourself.

34. Set everything to autopay

Setting everything to autopay is a great way to save time and avoid late fees on bills. By automating your payments, you guarantee that your bills are paid on time, with no hefty late fees or stressful reminders each month.

This can help you avoid costly late fees and also simplify your finances. Additionally, some companies offer discounts or lower interest rates for customers who set up autopay, so it’s worth checking with your service providers to see if this is an option.

35. Know the importance of saving

Making more money is an obvious solution to financial problems, but it’s not always feasible to have a high income. Instead of solely relying on increasing your income, it is vastly important to prioritize managing your expenses and finding ways to save money.

Everybody focuses on increasing their income but underestimates the power of saving money by planning a budget and cutting unnecessary expenditures. By being mindful of your spending habits, you can make the most of your resources and achieve financial stability.

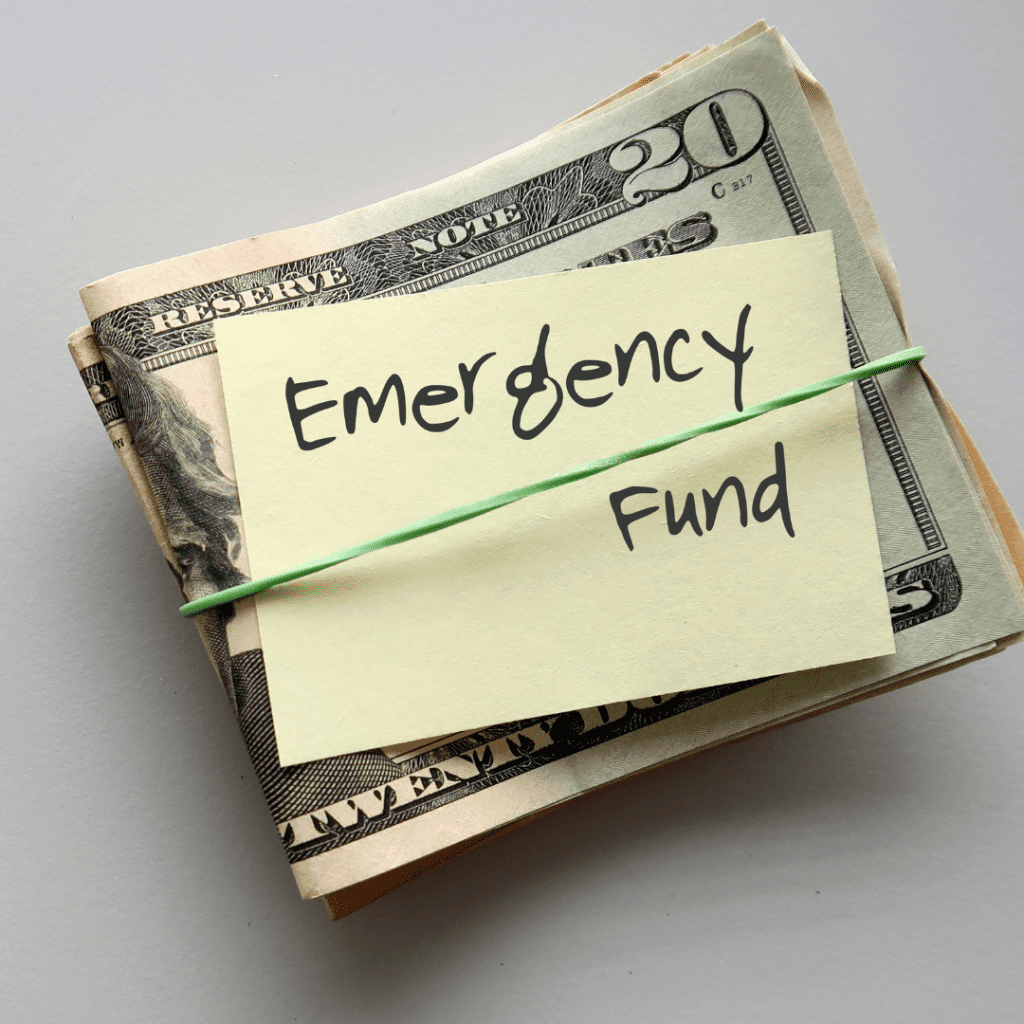

36. HYSA for an emergency fund

Keeping an emergency fund is essential for unexpected expenses, and it’s best to store it in a high-yield savings account (HYSA) to earn a decent return. With the increase in interest rates, HYSA has become more beneficial than traditional savings accounts or credit unions.

It’s recommended to shop around for the best rates and terms, and some online banks offer higher interest rates than brick-and-mortar banks. Make sure you read all the terms and conditions of the account and ensure that it’s FDIC-insured for safety.

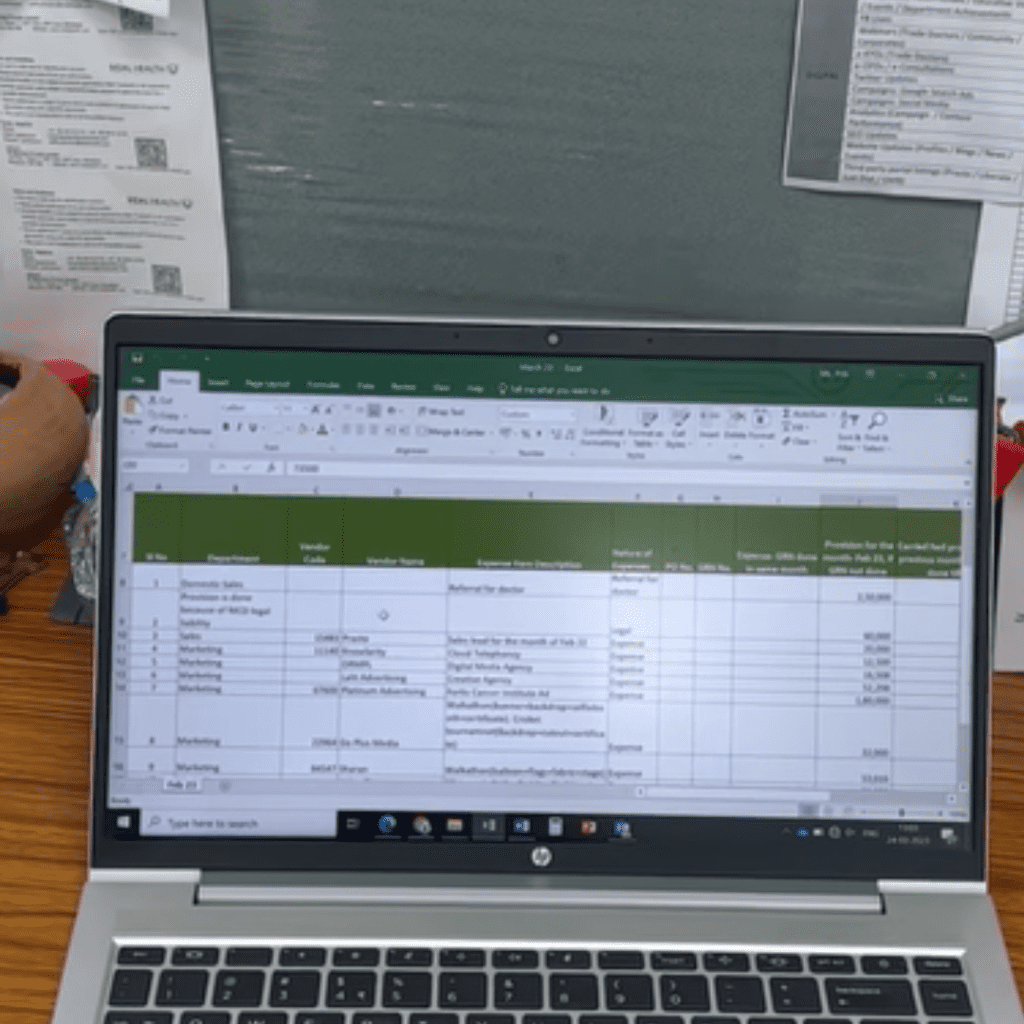

37. Excel sheet for expenses

Creating and regularly updating an Excel sheet for tracking expenses can be a fruitful money-saving hack. By keeping a detailed record of your spending, you can better understand where your money is going and identify areas where you may be misspending.

It helps you make informed decisions about your finances so you can find ways to cut back on unnecessary expenses. Furthermore, having a clear picture of your expenses can help you set and stick to a budget, which is an important step toward achieving financial stability and reaching your financial goals.

38. Grocery shopping on a budget

You can significantly reduce your grocery bill by buying and eating food that is on sale and using coupons. Many big grocery stores offer discounts on certain products or have sales at specific times, so it’s a good idea to keep a check through their flyers regularly.

If a product is not on discount, consider holding off on buying it until it goes on sale. Additionally, avoid buying produce when it’s not in season, as it may be more expensive. Also, consider buying oddly shaped produce; it tastes the same but may be found at a discounted price.

39. Try Dollar Stores

The dollar store is a superb place to find deals on everyday items. These stores always have a wide variety of items, from household necessities or even food. Just make sure to compare prices and check the quality of the products before you make a purchase.

Shopping at the dollar store allows you to save extra money on everyday essentials that everyone normally buys at a higher price at a regular store. You can also buy things in bulk that are frequently needed, such as toilet cleaner, to save even more money.

40. Save on transportation

Commuting by public transport not only saves money on gas and car maintenance, but you also avoid parking fees and potential traffic violations. In addition, you can use the time spent commuting to read or relax instead of stressing over traffic.

If biking, it’s essential to invest in a quality bike and gear to ensure safety and comfort during the ride. Those costs are significantly less than those associated with cars. Moreover, it is an eco-friendly mode of transportation that helps reduce your carbon footprint.

41. Follow a cash-only policy

One effective way to prevent impulse purchases and stick to a budget is to only carry a limited amount of cash when leaving the house. When you have a specific budget and bring only the cash needed for the day, you are less likely to buy unnecessary items.

This tactic will also help in developing discipline and self-control when it comes to managing finances. It is essential to carefully manage expenses and stick to the budget, which will ultimately lead to more significant savings over time. You can set a limit like, carrying 60 bucks every day with you.

42. Annual house maintenance

Make small but necessary repairs in the house annually to prevent bigger issues in the future. By keeping track of all the necessary maintenance and repairs, one can avoid the cost of major repairs that could have been prevented with timely intervention.

Make a calendar that includes things like changing air filters, cleaning gutters, checking the HVAC system, and other preventative measures. Following this calendar can help catch issues before they become bigger and more costly problems. It’s also helpful to assign specific dates for each task to ensure they are completed in a timely manner.

43. Invest in a quality espresso machine

Investing in a high-quality espresso machine and bean grinder can save money for coffee lovers. While it may be a higher upfront cost, it eliminates the need for daily trips to coffee shops and cafes, saving money on expensive drinks.

Additionally, purchasing high-quality beans in bulk and grinding them fresh at home can be cheaper than buying that pre-packaged coffee. Over time, this investment can result in significant savings while still allowing for the enjoyment of a daily coffee fix.

44. Do batch cooking

Batch cooking and group buying can be excellent money-saving hacks for those who are looking to cut their monthly expenses. By dedicating one weekend a month to cooking large batches of food, you can stock up your freezer with healthy, homemade meals that are easy to reheat and enjoy throughout the week.

Additionally, group buying can help you save money by purchasing groceries in bulk with family and friends, reducing the overall cost of groceries. And with ready-made meals in your freezer, you’ll reduce the temptation to get take-out on lazy days.

45. Monthly savings for rainy days

One key to financial stability is having an emergency fund, and saving just a small part every month can make a big difference. Many people find themselves in a difficult financial situation because they don’t have any savings to fall back on in times of need.

By putting away a small amount each month, you can gradually build up an emergency fund that can help you weather unexpected expenses or income disruptions. This can also help reduce the need for relying on high-interest loans or credit cards to cover unexpected expenses.